Life Loans Reviews

Life Loans Reviews - In this monevo lifeloans.com (life loans) review, you will find information about this company, its conditions, reputation. This rating has been given by an algorithm based on public sources such as whois, the ip address of the server, the location of the company and if the website has been reported on spam and phishing lists. The scam detector’s algorithm gives this business the following rank: You can decide if it’s the one for you by reviewing their advantages and disadvantages below. With just one easy application, they will submit the information you filled out to their network of lenders who will then compete for your business. This life loans review presents you with one of the many online lending platforms available. Life loans is one of the many loan aggregators that allow to borrow between $100 and $40,000. 100.0/100 the maximum rating was given to www.lifeloans.com for a few different reasons. We will also discuss the pros and cons of life loans loans, and answer the question: They offer both short term loans and longer term installment loans. Lifeloans.com review resulted in a trust score of 77. Web 4.5 nerdwallet rating the nerdy headline: Web from 2022 to 2023, the size of the average personal loan taken out in the previous 12 months by those who got one from a financial institution rose 25%, from $5,046 to $6,299, according to a new. With just one easy application, they. The scam detector’s algorithm gives this business the following rank: In this article, we'll also show you a few other fraud prevention tips including what to do if you lost money to a scam. In this monevo lifeloans.com (life loans) review, you will find information about this company, its conditions, reputation. Web 4.5 nerdwallet rating the nerdy headline: This rating. This life loans review presents you with one of the many online lending platforms available. They offer both short term loans and longer term installment loans. Web compare the pros and cons of life loans. Web from 2022 to 2023, the size of the average personal loan taken out in the previous 12 months by those who got one from. You can decide if it’s the one for you by reviewing their advantages and disadvantages below. In this monevo lifeloans.com (life loans) review, you will find information about this company, its conditions, reputation. Web in this article, we will take a comprehensive look at life loans reviews to see what current and former customers have to say about the company.. We will also discuss the pros and cons of life loans loans, and answer the question: Web from 2022 to 2023, the size of the average personal loan taken out in the previous 12 months by those who got one from a financial institution rose 25%, from $5,046 to $6,299, according to a new. Web compare the pros and cons. Web in this article, we will take a comprehensive look at life loans reviews to see what current and former customers have to say about the company. Web 4.5 nerdwallet rating the nerdy headline: Lifeloans.com review resulted in a trust score of 77. Web personal loan companies will check your credit through national databases that track consumer lending transactions (such. Web personal loan companies will check your credit through national databases that track consumer lending transactions (such as teletrack, dp bureau, or datax) or through the three major credit reporting bureaus (experian, equifax, and trans union). In this article, we'll also show you a few other fraud prevention tips including what to do if you lost money to a scam.. This life loans review presents you with one of the many online lending platforms available. Lifeloans.com review resulted in a trust score of 77. Web personal loan companies will check your credit through national databases that track consumer lending transactions (such as teletrack, dp bureau, or datax) or through the three major credit reporting bureaus (experian, equifax, and trans union).. Web compare the pros and cons of life loans. Lifeloans.com review resulted in a trust score of 77. Web from 2022 to 2023, the size of the average personal loan taken out in the previous 12 months by those who got one from a financial institution rose 25%, from $5,046 to $6,299, according to a new. Web personal loan companies. However, loan review procedures do vary by company. Web from 2022 to 2023, the size of the average personal loan taken out in the previous 12 months by those who got one from a financial institution rose 25%, from $5,046 to $6,299, according to a new. Is life loans worth it? This rating has been given by an algorithm based. The scam detector’s algorithm gives this business the following rank: In this article, we'll also show you a few other fraud prevention tips including what to do if you lost money to a scam. They offer both short term loans and longer term installment loans. We will also discuss the pros and cons of life loans loans, and answer the question: Web from 2022 to 2023, the size of the average personal loan taken out in the previous 12 months by those who got one from a financial institution rose 25%, from $5,046 to $6,299, according to a new. With just one easy application, they will submit the information you filled out to their network of lenders who will then compete for your business. This life loans review presents you with one of the many online lending platforms available. Is life loans worth it? Lifeloans.com review resulted in a trust score of 77. Life loans is one of the many loan aggregators that allow to borrow between $100 and $40,000. 100.0/100 the maximum rating was given to www.lifeloans.com for a few different reasons. However, loan review procedures do vary by company. In this monevo lifeloans.com (life loans) review, you will find information about this company, its conditions, reputation. This rating has been given by an algorithm based on public sources such as whois, the ip address of the server, the location of the company and if the website has been reported on spam and phishing lists. Web in this article, we will take a comprehensive look at life loans reviews to see what current and former customers have to say about the company. Web compare the pros and cons of life loans. Web we think lifeloans.com is legit as we found few indicators which might point to a scam. You can decide if it’s the one for you by reviewing their advantages and disadvantages below. Web 4.5 nerdwallet rating the nerdy headline: Web personal loan companies will check your credit through national databases that track consumer lending transactions (such as teletrack, dp bureau, or datax) or through the three major credit reporting bureaus (experian, equifax, and trans union).Life Insurance For Loans, Getting Coverage for Approval CFA Insurance

Life Insurance and Student Loan Debt What You Need to Know

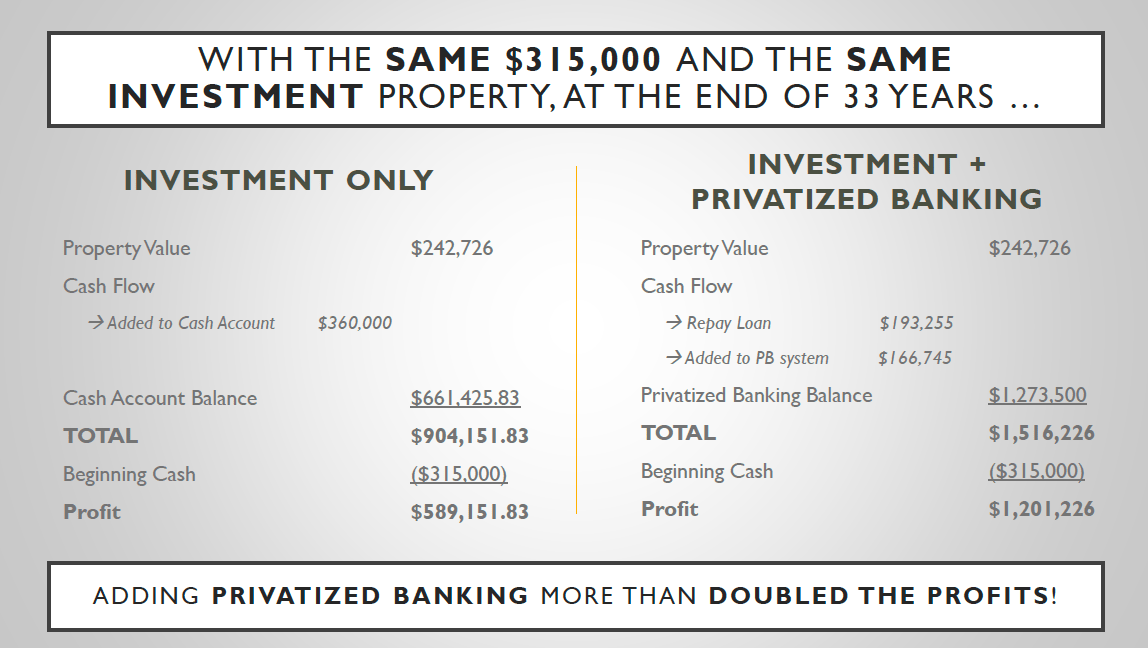

Life Insurance Loans and Why We Use Them Privatized Banking

Discover Personal Loans Reviews

Why life insurance and student loans should go hand in hand [rates]

Blog IBC Global Inc

Life Loans Review 2020 APR , Fees, Eligibility and More

Chapter 2 Loan Life Cycle YouTube

Lifeloans Fill Out and Sign Printable PDF Template signNow

Life Insurance Loans [Avoid Taxes With These Tips]

Related Post:

![Why life insurance and student loans should go hand in hand [rates]](https://onestoplifeinsurance.com/wp-content/uploads/2017/10/Student-loans-pro-cons.jpg)

![Life Insurance Loans [Avoid Taxes With These Tips]](https://www.insuranceandestates.com/wp-content/uploads/life-insurance-loans-1-2048x1365.jpg)